Table of Contents

The rate you see on Google and the rate you get at the airport are never the same. That mismatch often comes from the bid/ask spread, markups and hidden fees placed by banks, kiosks and card networks. If you travel, send money, or manage cashflow across borders, understanding how forex rates are made will save both time and money. This guide explains how the retail rates you encounter differ from the mid-market rate, what moves exchange rates, and practical ways to get better value when converting money.

1Forex market basics

The foreign exchange (forex) market is the largest financial market by daily volume — trillions of dollars change hands each day. It runs 24 hours on business days, connecting central banks, commercial banks, brokers, hedge funds and retail platforms. Prices form through supply and demand: bids and offers match to create trades that move the market.

Who participates and why it matters

Participants include central banks (policy and reserves), commercial banks (payments, hedging), corporations (trade and payroll), funds (speculation) and travellers (retail conversions). Each actor has different goals; big players can move rates in seconds, while retail traders get prices through intermediaries.

How prices form in practice

Market makers quote two prices: a bid (price they buy at) and an ask (price they sell at). When a buyer and seller agree, the trade uses the posted prices, and the latest traded price becomes part of the market history used to set the mid-market rate.

A brief history in one paragraph

Modern forex evolved after the end of Bretton Woods in 1971, when major currencies began floating. That shift created a true market for exchange rates. Events like Black Wednesday (1992) show how political moves and speculation can force sharp currency moves.

2Bid vs Ask spread explained

Bid and ask are the two prices market makers display. The spread (ask minus bid) is how intermediaries earn from trades. For highly liquid pairs like EUR/USD the spread might be a few tenths of a pip in interbank markets, but retail spreads are wider after markups.

Definitions with example

If EUR/USD is quoted as 1.1000/1.1003, the bid is 1.1000 (what the market maker will pay for euros) and the ask is 1.1003 (what they sell euros for). A customer buying euros pays 1.1003; selling receives 1.1000. The 0.0003 difference is the spread.

Why spreads vary

Spreads widen when liquidity drops (overnight, holidays, or for exotic pairs) and during volatility (economic releases, political shocks). Retail providers add fixed markups to cover costs and profit, so the spread you see on a travel app will usually be larger.

Hidden spread costs

Some services show a mid-market price but apply their margin in the rate used for conversion. That hidden spread feels invisible because you don't see separate fees, but it increases your effective cost per transaction.

3Mid-market rate vs retail rate

The mid-market rate (also called interbank rate) is roughly the midpoint between the best bid and ask across major liquidity providers. Retail rates include commissions, markups and fees and are rarely equal to the mid-market price.

How to recognize mid-market

Mid-market appears on financial feeds and aggregator sites. It reflects large institutional trades and is best used as a reference. Most consumer exchanges and banks quote rates away from this midpoint to protect their margins.

How retail providers add costs

Retail costs appear as a worse exchange rate, an explicit commission, or both. For example, a bank charging a 2% margin on the mid-market rate will give you fewer foreign currency units for the same home currency amount.

Quick check: compare before you exchange

Open a mid-market feed (search ‘EUR USD mid-market rate’) and compare the implied rate from a bank quote. If your bank’s rate is 1–3% worse, that gap is the price you pay for convenience and perceived safety.

4Factors affecting exchange rates

Exchange rates move for many reasons: interest rate differences, inflation, economic growth, trade balances, central bank intervention, political events and market sentiment. Expectations often matter as much as current data.

Macro drivers: rates, inflation and growth

Higher interest rates often attract capital, supporting a currency. Conversely, high inflation tends to weaken it. Traders watch central bank statements and economic releases (CPI, employment) because those change expectations fast.

Political risk and sudden moves

Elections, wars, sanctions or abrupt policy changes can trigger big swings. Black Swan events push participants to the sidelines, widen spreads and make retail conversions more expensive.

Market psychology and speculation

Speculators amplify moves. Herding behavior and algorithmic trading can create momentum. For example, rumor-driven flows can move a thinly traded currency much more than its importantes would suggest.

5Best ways to exchange currency & hidden fees

How you exchange matters. Options include banks, airport kiosks, online brokers, specialist money transfer services, ATMs abroad and credit/debit cards. Each choice has pros and cons for price, convenience and safety.

Cash vs cards vs transfers

Cash avoids later bank fees but can carry a worse rate at kiosks. Cards give competitive interbank rates but card networks and banks may add foreign transaction fees and dynamic currency conversion (DCC). Bank transfers and remittance services often offer the best large-sum rates.

Common hidden fees to watch

Look for DCC (merchant asks to charge in your home currency), ATM operator fees plus your bank's out-of-network fee, inactivity fees on prepaid travel cards, and flat commissions. Together, these can add 2–5% or more to the effective cost.

How to get the best value

For small amounts, use a debit card that has no foreign transaction fee and accepts chip-and-PIN. For larger sums or frequent transfers, use an online FX provider or bank that offers close-to-mid-market rates and transparent commissions. Always compare the effective rate after fees.

6Practical tips, common mistakes and quick math

A few habits go a long way: avoid airport exchanges when possible, refuse DCC, check the mid-market rate, and split sources—carry a small amount of cash and a fee-free card. Mental math shortcuts help spot bad deals fast.

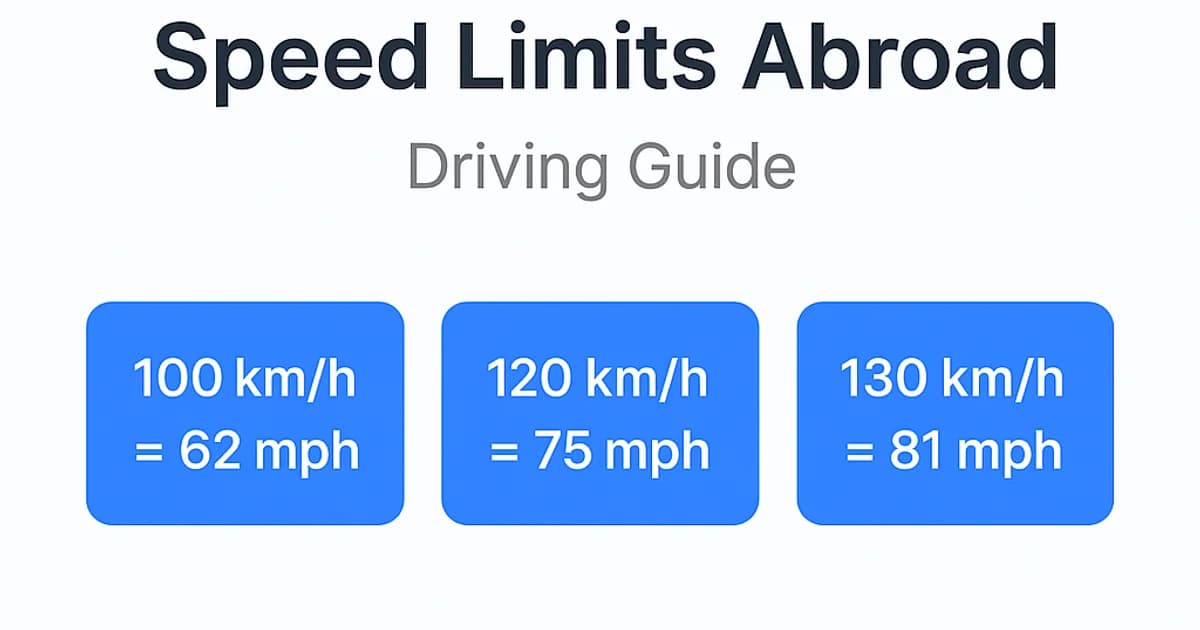

Mental math shortcuts

To go from EUR to USD roughly multiply by 1.1 (or divide USD by 1.1 to get EUR) when EUR/USD is near 1.10. For a quick check, treat 1/1.6 as 0.625 to convert miles/km-style conversions when needed for rough estimates.

Top common mistakes

The #1 error is accepting DCC at checkout. Another is trusting kiosk rates without comparing. Also avoid withdrawing only once large amounts from an ATM if your daily limit imposes extra fees — plan ahead.

Real-world scenarios

When sending payroll abroad, companies hedge FX risk using forward contracts. When travelling, convert a small amount beforehand and use cards with no FX fee for the rest. Money transfer apps beat banks for cross-border person-to-person payments in many corridors.

Pro Tips

- 1Always check the mid-market rate online before converting money to spot markups.

- 2Avoid Dynamic Currency Conversion (DCC): ask to be billed in the local currency.

- 3Use debit or credit cards with no foreign transaction fee for convenience and good rates.

- 4For larger transfers, compare specialist FX services — they often beat banks on both rate and fee.

- 5Carry a small amount of local cash and use cards for most purchases to reduce exchange losses.

Exchange rates are market prices shaped by many players and factors. The mid-market rate is a useful benchmark, but retail rates include spreads and fees that determine what you actually receive. Learning to spot bid/ask spreads, refusing DCC and comparing providers will save money over time. Try our related converters to see the mid-market rate and then compare that to what your bank or card offers. Use the tips above when travelling or sending money abroad to keep more of your own currency.